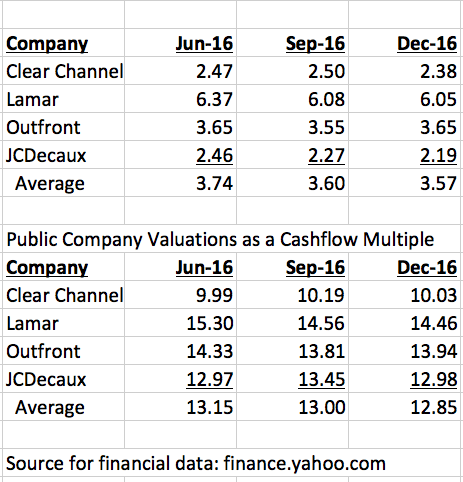

Public outdoor company valuations shrank slightly during the fourth quarter of 2016 as this chart demonstrates.

Public Outdoor Company Valuations December 2016

- The average revenue multiple for the four public outdoor companies shrank from 3.60 times to 3.57 times. JCDecaux, Clear Channel Outdoor and Outfront trade at a lower revenue multiple than Lamar because they rely more on transit advertising where leases are 5-10 years versus a 20 year standard lease in the billboard business.

- The average cashflow multiple for the four public outdoor companies shrank from 13.00 times to 12.85 times. The debt/cashflow trading multiple at the public outdoor companies is important for you to track if you are an independent owner because it represents the ceiling a public billboard can pay for your company’s assets without harming shareholders. The public outdoor companies will try to buy your company for less but will almost never pay more than their own company’s cashflow multiple.

- Clear Channel trades as a lower cashflow multiple than the other public outdoor companies because it has debt/cashflow of 7.5:1 which is almost twice the leverage of the peer group. A dollar of risky cashflow gets valued at a lower multiple than a dollar of safe cashflow.

- Private market values are 8-12 times cashflow or 4-6 times revenue.

- Easement values at 6-10 times cashflow.

Paid Ad