Outfront announced that two of their wholly-owned subsidiaries priced a private offering of $650,000,000 in aggregate principal amount of 5.000% Senior Notes due 2027. Outfront intends to use the net proceeds from the notes offering, together with cash on hand, to redeem all of its outstanding $550 million 5.250% Senior Notes due 2022, to pay accrued and unpaid interest on such outstanding notes, to pay fees and expenses in connection with the notes offering and redemption, and to partially repay amounts outstanding under its senior credit facilities and accounts receivable securitization facilities.

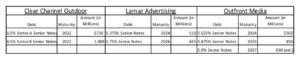

So Outfront was able to replace a credit facility and lower their interest costs by a quarter of a point. A quarter point doesn’t seem like much but it is $1.625 million in interest savings on $650M annually. Insider was curious as to how the Senior Debt compares to Lamar and Clear Channel so we did a little comparison shopping focused on Senior debt.

Insider’s Take – So what do we learn? First, risk is always an issue. Clear Channel has higher overall leverage so their debt is more expensive. Second, there is still downward pressure on interest rates as the institutional banking market is competitive. Good time to be refinancing, but watch your leverage levels.

[wpforms id=”9787″]

Paid Advertisement