Here are five things Insider learned from reading the Clear Channel Outdoor 2018 10-k:

Here are five things Insider learned from reading the Clear Channel Outdoor 2018 10-k:

IHeart’s looting is about to stop. The 10-k says Clear Channel Outdoor will separate from iHeart Media in the second quarter of 2019. In connection with the spin-off Clear Channel Outdoor will:

- Cease paying $39 million/year in annual “royalties” to iHeart for the use of trademarks.

- Receive forgiveness on a net $12 million in payments which Clear Channel Outdoor owes iHeart post-bankruptcy

- Receive $149 million in cash on its $1 billion loan to iHeart.

- Receive a $200 million three year line of credit from iHeart.

Sounds good if you overlook that fact that Clear Channel Outdoor has transferred a net $7.6 billion to iHeart over the past 7 years without getting anything in return.

A majority of revenues come from outside the US. 56% of revenue comes from Clear Channel International (Europe, Asia and Latin America) and 45% of revenue comes from Clear Channel Americas (primarily US). No wonder William Eccleshare, the former head of Clear Channel International, will become the CEO of the independent Clear Channel Outdoor.

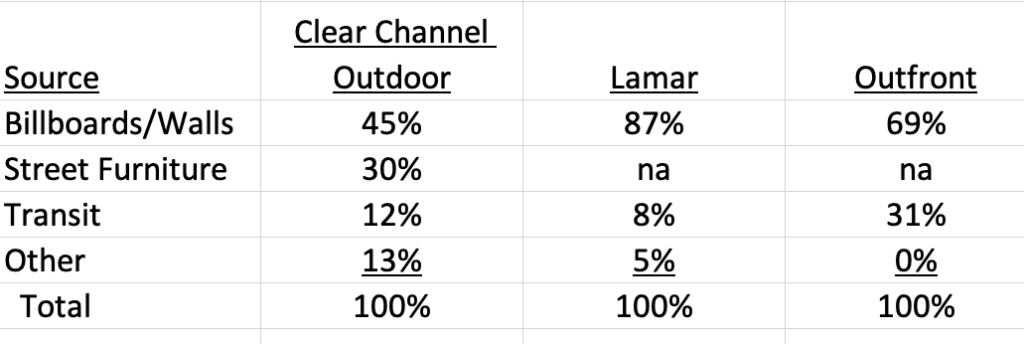

Revenues are diversified. Clear Channel Outdoor’s revenue is more diversified than Lamar or Outfront because the international operations are highly reliant on street furniture. See this chart.

2018 Revenues by Source

Creditors hold the strings. The creditors have locked down Clear Channel Outdoor. Total Debt/Cashflow and Senior Debt/Cashflow were 8.7 and 4.5, respectively, at December 31, 2018. Clear Channel Outdoor’s debt agreements prohibit additional debt or dividends from asset sales until Total Debt/Cashflow and Senior Debt/Cashflow have declined below 7.0 and 5.0, respectively. Looks to Insider like Clear Channel Outdoor’s creditors have finally wised up after seeing what happens when you don’t restrict additional debt and dividends. Insider thinks that Total Debt/Cashflow of 7:1 is too high to be sustainable . A better target would be 5:1.

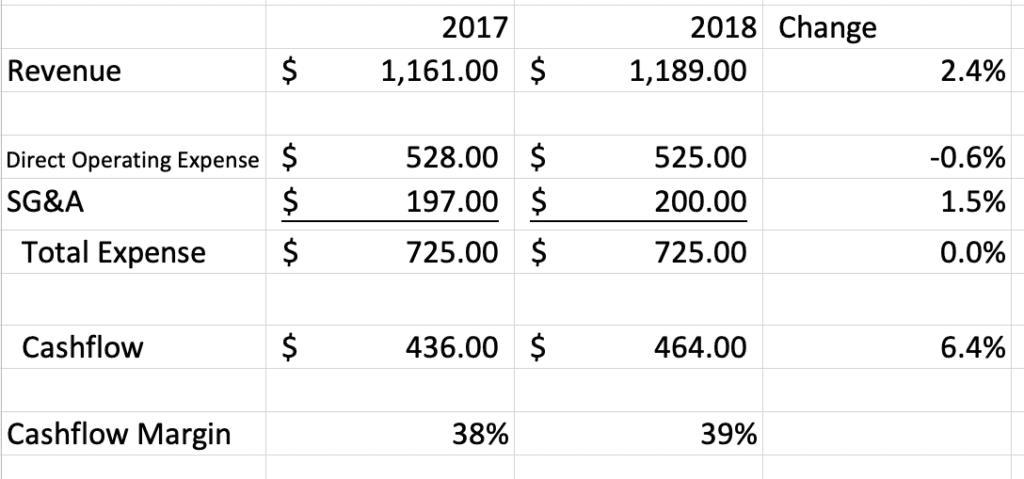

The US operation didn’t do too badly. It’s a sign of a well managed company when revenues grow faster than expenses. That happened in the US during 2018.

Clear Channel Outdoor Americas Revenue and Cashflow (millions)

[wpforms id=”9787″]

Paid Advertisement