Here are five things Insider learned after reading Boston-Omaha’s 10k and Annual Letter. The annual letter is a model for how to communicate clearly with investors without hiding behind legalese. Boston-Omaha is the parent of Link Media Outdoor.

Here are five things Insider learned after reading Boston-Omaha’s 10k and Annual Letter. The annual letter is a model for how to communicate clearly with investors without hiding behind legalese. Boston-Omaha is the parent of Link Media Outdoor.

The investment thesis: barriers to entry and attractive investment opportunities. The 10-k summarizes why Boston-Omaha likes the out of home business in one sentence: “We are attracted to the outdoor display market due to a number of factors including high regulatory barriers to building new billboards in some states, growing demand, low maintenance capital expenditures for static billboards, low cost per impression for customers and the potential opportunity to employ more capital in existing assets at reasonable returns in the form of perpetual easements and digital conversions.” Insider can’t say it better.

It’s the Alex and Adam Show. Alex Buffet Rozek and Adam Peterson control 69% of the voting stock via direct or affiliated investments. Rozek is 40. Peterson is 37. Expect this company to be around for a long time.

Acquisitions, Acquisitions, Acquisitions. Boston Omaha has spent $220 million on 16 out of home companies since 2015. It expects to buy more. The annual letter says:

Historically, there have generally been two types of large buyers in the billboard business: “perennial daters,” who purchase boards with the intent to resell at some later date (private equity is a good example), and “the marrying kind.”

We are the marrying kind.

Last year a remarkable number of billboard assets came to market. Anecdotally, one key broker in the business indicated the dollar amount of deals in 2018 has been three times their normal amount. We like the billboard business, so when a lot of billboards are for sale in attractive markets, it is important to seize the opportunity, while always being mindful of price.

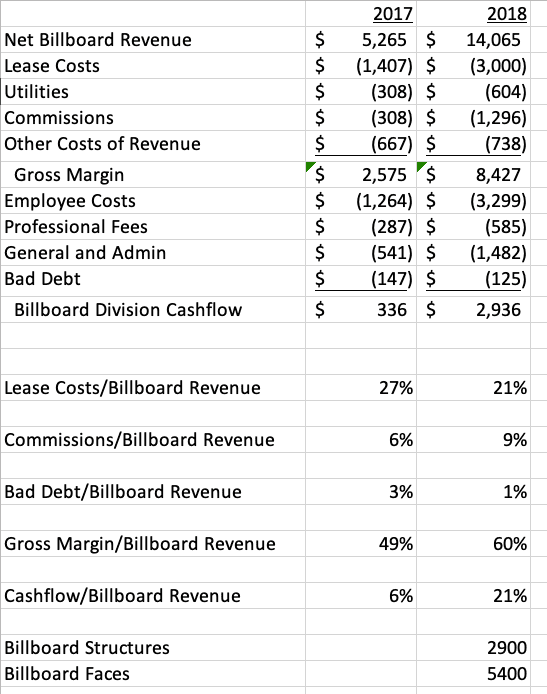

Link Media Matures. Link Media Outdoor has moved from startup stage to mature company stage. Lease costs are down from 27% in 2017 to the 20% industry norm due to increased revenues. The company’s cashflow margin improved from 6% in 2017 to 21% in 2018. Here are Link Media Outdoor’s numbers.

No Debt But That Could Change. Link Media Outdoor has no debt but if I were a banker or investment banker I’d be bringing debt ideas. Here’s what the annual letter says: “Finally, no discussion about Link would be complete without mentioning that, to date, we have zero debt. That will not always be the case as a conservative amount of Link debt (non-recourse to Boston Omaha) at relatively low cost makes sense to us in the billboard business given its many variable costs and low capital requirements. We are actively exploring our options with an emphasis on the aforementioned “conservative”.

[wpforms id=”9787″]

Paid Advertisement