On Friday Insider wrote that debt for an out of home advertising company should not exceed 5 times cashflow (earnings before interest, depreciation and amortization) or 3 times revenue. This is the upper limit. It’s OK to operate way below this if your risk tolerance is less. This analysis is focused at small independent billboard operators.

On Friday Insider wrote that debt for an out of home advertising company should not exceed 5 times cashflow (earnings before interest, depreciation and amortization) or 3 times revenue. This is the upper limit. It’s OK to operate way below this if your risk tolerance is less. This analysis is focused at small independent billboard operators.

Here’s why 5 times EBIDTA or 3 times revenue is a good limit on debt. Most independent out of home companies trade at 8-10 times cashflow or 4-6 times gross revenue. During strong markets out of home companies will trade at 6 times gross revenue or 10 times cashflow. In a recession, multiples will contract to 4 times revenue or 8 times cashflow. If you borrower no more than 5X cashflow your company will be probably be worth more than the value of its debt and avoid defaulting on debt even if there is a recession.

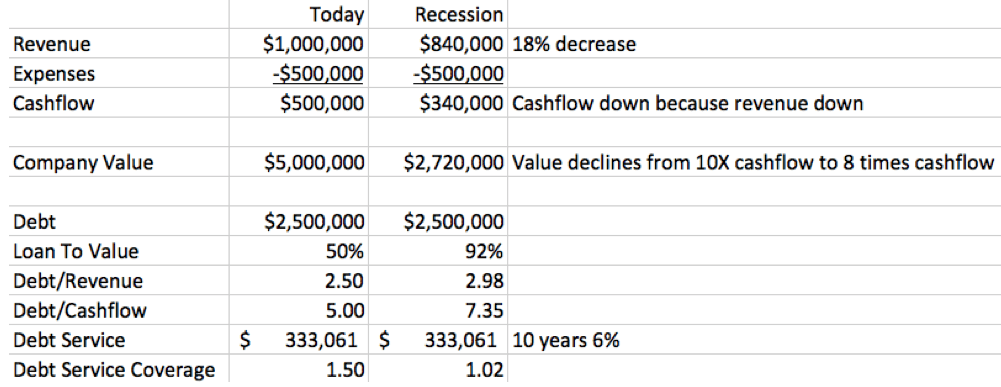

Take the example below. Your out of home company is generating $1 million of annual revenue, $500,000 of expense and $500,000 of cashflow. You borrow $2.5 million (5 times cashflow of 2.5 times revenue). Your annual debt service is $333,000. A recession occurs. Revenues decline by 18% which is what happened in 2009. Out of home investors become more conservative and multiples decline from 10X cashflow to 8X cashflow. The value of your company has shrunk from $5 million to $2.7 million but you are still solvent. The value of your company is worth more than your debt of $2.5 million. Even more importantly, your cashflow of $340,000 is sufficient to handle debt service of $333,000 without defaulting.

[wpforms id=”9787″]

Paid Advertisement