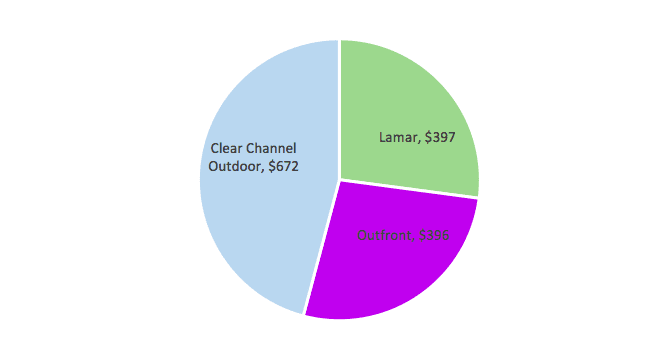

Here are two surprising pie charts on the three big public US out of home companies. The first pie chart shows revenues for Clear Channel Outdoor, Lamar and Outfront Media for the financial quarter ended June 30, 2017. Insider thought there was a typo when he first compiled the chart. He rechecked the data to make sure. Clear Channel Outdoor’s revenues are 70% larger than Lamar and Outfront.

Revenue (Million Dollars) for the Quarter Ended June 30, 2017

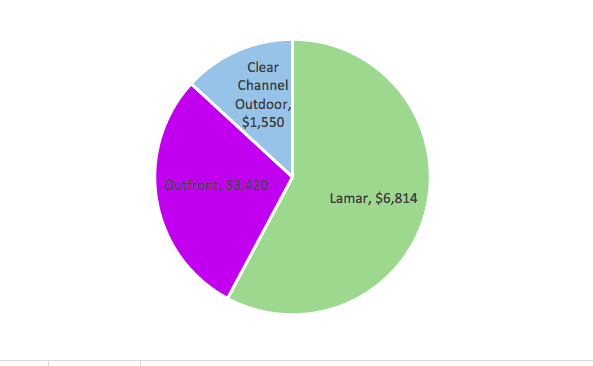

The second pie chart shows the market capitalization for Clear Channel Outdoor, Lamar and Outfront Media as of last Friday. Lamar has three times the market cap of Clear Channel despite being 70% smaller. Lamar has twice the market cap of Outfront despite being the same size.

Market Capitalization (Million Dollars) at October 12, 2017

Insider thinks there are three reasons why Lamar is more valuable than Outfront and Clear Channel Outdoor.

- Lamar is less reliant on short term transit and airport advertising contracts and less reliant on international out of home revenues. Bulletins may not be sexy but the market assigns a higher cashflow multiple to bulletins because they involve stable 20 year leases which have lease expenses of 10-20% of revenue versus 3-10 year transit contracts which have lease costs of 20-50% of revenue. Domestic US out of home revenues get assigned a higher valuation by the market than overseas out of home revenues where property rights and the rule of law may not be so assured.

- Lamar has higher cashflow margins. Lamar’s managers seems to be able to get more out of each dollar of revenue.

- Clear Channel Outdoor’s market cap is dragged down by speculation that either Clear Channel Outdoor or iHeart Media or both will have to file for Chapter 11 bankruptcy protection.

We’ll expand on this in future posts.

[wpforms id=”9787″]

Paid Advertisement

nice article Dave.