“All in all it’s a decent start of the year” said Outfront CEO Jeremy Male when Outfront released first quarter 2018 financials. Here are the results of the earnings release , investor presentation and conference call.

“All in all it’s a decent start of the year” said Outfront CEO Jeremy Male when Outfront released first quarter 2018 financials. Here are the results of the earnings release , investor presentation and conference call.

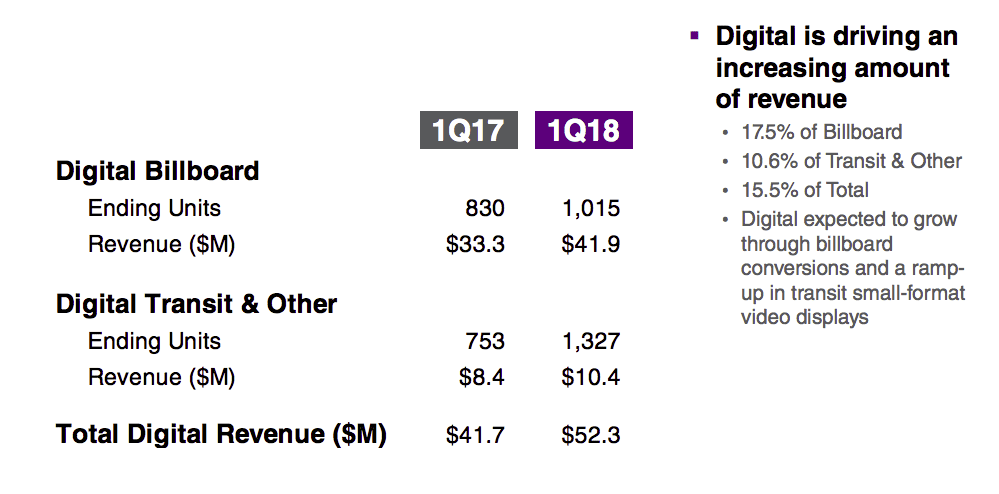

- Total Revenues grew 2.2% to $338 million. “Revenue growth of 2.2% was led by the strength and consistency of local advertising,” said CEO Jeremy Male. “We saw strong growth in our digital revenues driven by both digital billboards and the investments we have been making in our new digital displays.” Organic revenues, adjusted for acquisitions, grew 0.8%. The company said that revenue per display increased in the US. Local grew and national revenues declined. Here’s an overview of how the company’s digital billboard revenue is growing.

- Operating expenses increased 2.7% to $197 million due to higher MTA property lease costs, higher sports marketing expenses and higher strategic business development costs.

- Cashflow (OBIDAN) increased by 1% to $81 million.

- Capital expenditures were $62 million during the first quarter of 2018, nearly double the level of a year earlier due to payments due under the company’s MTA contract. The company converted 14 static billboards to digital in the US and 10 static billboards to digital in Canada. The quarter saw limited outlays for MTA smartboards, which aren’t expected to occur until the last half of the year.

- The company’s Debt/Cashflow was 4.9 at March 31, 2018, slightly above Outfront’s target of 3.5-4.0.

Insider’s take: Revenue is growing but the operating margin isn’t. The digital sign expansion, location-based audience selling and tech initiatives cost money. Outfront stock finished the day up 1% to $19.10.

[wpforms id=”9787″]

Paid Advertisement