Outfront Media released 2Q 2017 earnings. Here are the highlights from the earnings presentation, earnings release and conference call.

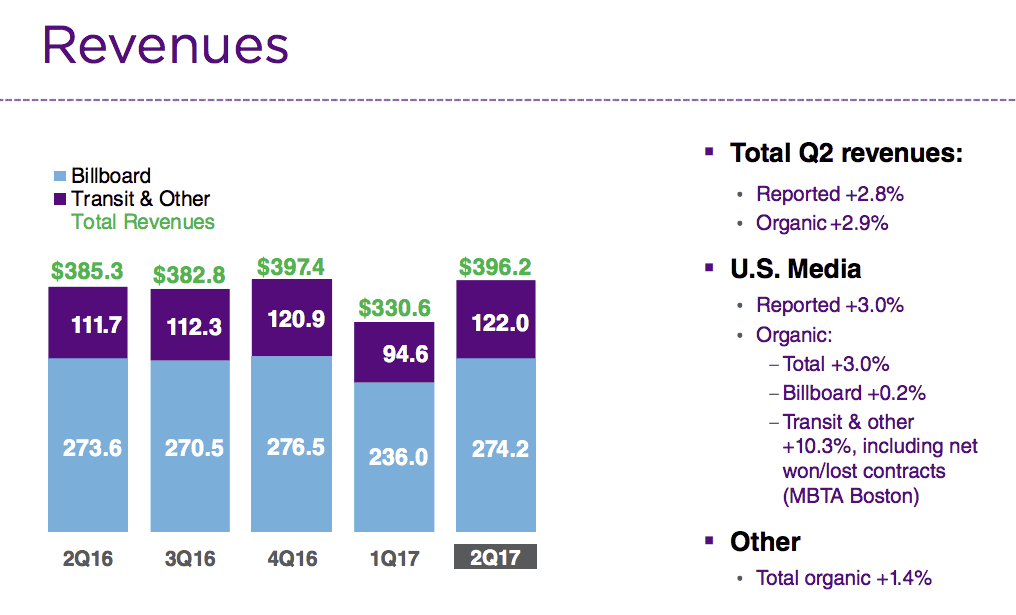

- Organic revenues adjusted for acquisitions increased by 3% to $396 million in the second quarter due to increased transit revenues. Transit revenues were up 9%. The company’s billboard revenues increased by only 0.2% in the quarter as increased revenues from digital conversions and condemnations were offset by a decrease in revenue per display and lower national advertising. Here’s a breakdown of revenue growth.

- Operating Expenses increased 6% to $213 million due to higher transit fees, higher corporate expenses, $600,000 in professional fees related to the acquisition of billboards in Canada and $1 million in stock compensation.

- Cashflow (OIBDA) declined by 1% to $122 million for the second quarter of 2017. The company ended the second quarter with an adjusted cashflow margin of 30.8%, versus 31.9% for the prior year.

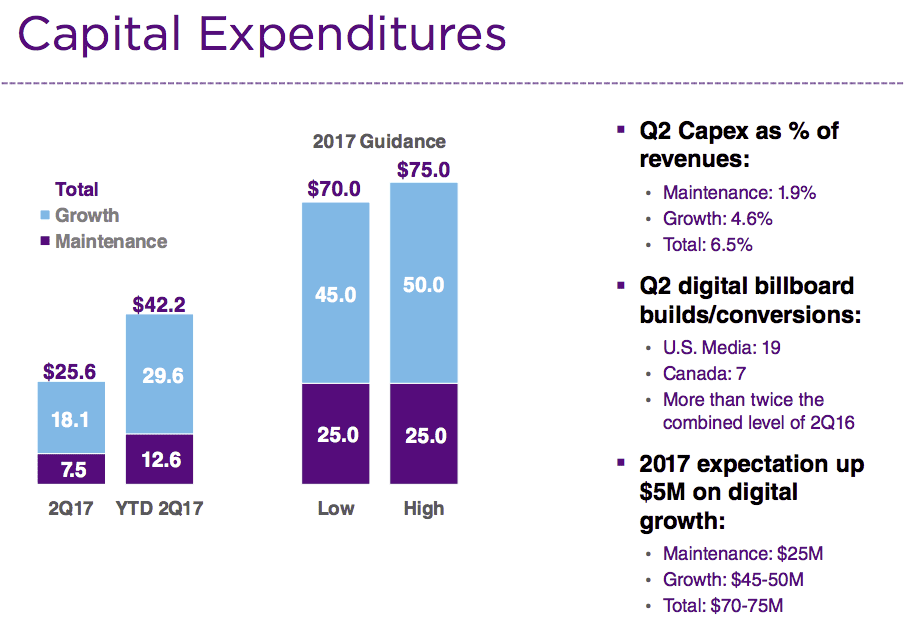

- Capital expenditures totaled $26 million for the quarter. You can see where the money went below.

- The company’s Debt/Cashflow is a moderate 4.9X which compares favorably with Clear Channel Outdoor’s 8.3X. This is reflected in borrowing costs. Outfront Media has a weighted average cost of debt of 4.8% versus 7.1% for Clear Channel Outdoor.

Insider’s take: Outfront’s transit group is doing well. Outfront Media and Clear Channel Outdoor US billboard revenues are going nowhere. Is the focus on sophisticated selling solutions like On Smart and Radar causing Outfront and Clear Channel Outdoor to lose out on plain vanilla location based sales? Outfront stock closed down 1% to $21.97.

[wpforms id=”9787″]

Paid Advertisement