On June 27 Cincinnati passed a 10% tax on billboard revenues as part of the city’s 2019 budget. The tax goes into effect July 1. The tax was passed over the mayors veto with two days public notice and no hearings. You can read more about the tax at WLWT5 and Cincinnati.com.

In testimony at the hearing, Norton Outdoor estimated that the tax will amount to $700,000 and will fall on just two companies: Norton Outdoor and Lamar Advertising.

Ken Klein of the OAA has this to say: “We support fair taxation. Fairness is violated when one form of speech is singled out for targeted taxation. Billboards are an increasingly dynamic medium for commercial and noncommercial speech, communicating ideas, points of view, news, and advertising messages.”

Insider’s take: It’s outrageous to pass a $700,000 tax with little public notice and no hearings. One of the Cincinnati city council members worried that the potential tax revenues may be offset by litigation. Do you think so? Baltimore’s billboard tax based on square footage which was enacted in 2013, faces a constitutional challenge filed by Clear Channel Outdoor. In 2003 New Jersey enacted a gross receipts tax on billboards. It was phased out due to strong opposition.

[wpforms id=”9787″]

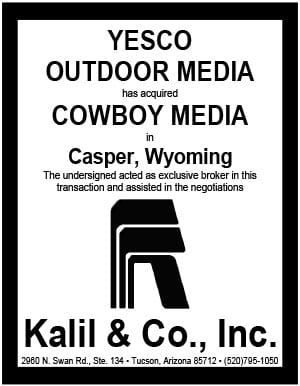

Paid Advertisement

Hasn’t Cincinnati tranist advertising? Since this is city property did they also impose an OOH advertising tax on tranist advertising?